Amazon Canada is refunding the taxes to the buyer off my payroll when an A to Z case is granted

I have had 3 A to Z claims this year on items delivered late.

Amazon collects all Canada taxes up front, but when my 3 A to Z claims were granted in favor of the buyer, Amazon refunded the buyer for:

The item, The Original Shipping Fee AND the taxes which were previously collect from the original sale.

This means that Amazon is committing fraud.

If Amazon is reading this, please contact me ASAP to discuss and rectify this grave issue.

Amazon Canada is refunding the taxes to the buyer off my payroll when an A to Z case is granted

I have had 3 A to Z claims this year on items delivered late.

Amazon collects all Canada taxes up front, but when my 3 A to Z claims were granted in favor of the buyer, Amazon refunded the buyer for:

The item, The Original Shipping Fee AND the taxes which were previously collect from the original sale.

This means that Amazon is committing fraud.

If Amazon is reading this, please contact me ASAP to discuss and rectify this grave issue.

30 respuestas

Seller_y7W9ccUlauftE

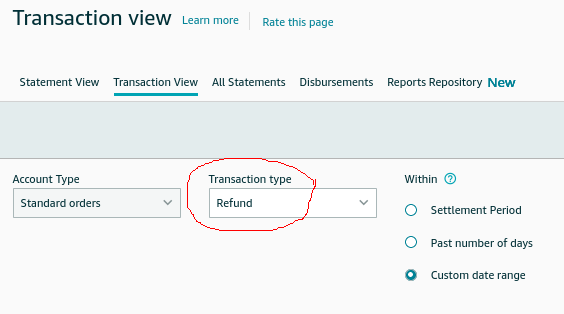

The sales tax portion should be reclaimed from whoever handled the sales tax (from the seller if registered or from amazon if under marketplace rules).

The order detail page does NOT show you where the refund money is coming from. It just shows the buyer's viewpoint of the sale.

Check your transaction details to see where the money being refunded actually comes from.

sellercentral.amazon.ca/payments/event/view

...

Amazon should be refunding some of their fees on the sale (but for some categories amazon has a refund administration fee that reduces what you get back)

Seller_7LrAV0m5llaI7

were granted in favor of the buyer, Amazon refunded the buyer for:

The item, The Original Shipping Fee AND the taxes which were previously collect from the original sale.

Yes, and? You don't think that the buyer should get their sales tax back on a refund?

Seller_kmRhEEJyqRIrB

Hello,

I would like a resolution to this serious problem immediately. Amazon is committing fraud when it comes to granting AZ claims.

Please escalate this to a supervisor and have them contact me asap.

I tried to reach out numerous time Amazon support and the agents keep closing my cases thinking I am the buyer.

Please look into the 3 AZ orders to which the taxes were deducted off my pay:

Order ID: 702-0178476-0492278 - Amazon owes me $15.10 in taxes

Order ID: # 701-5392237-0501800 - Amazon owes me $25.45 in taxes

Order ID: # 701-9713178-7691447 Amazon owes me $29.49 in taxes

I want a resolution by this week, I will take this to media and lawyers if I have to.

Seller_7LrAV0m5llaI7

Amazon passes us the taxes since we have a registered GST/HST number and PST Number, so it would only make sense they take it back away from us.

Seller_1idNlTUpfKbZW

It's not fraud - it's Trudeau's "great" new law introduced in 2021, where Amazon and other online marketpalces are required to remit part of the HST. Now, if it's refunded, the buyer has nothing to do with this and needs to be refunded his full amount and taxes.

Since the taxes were already remitted, it's up to YOU to obtain it back from the government when doing your HST taxes. Amazon is not keeping it - the government is, and they will pay you back once you do your taxes.

Seller_7LrAV0m5llaI7

This is normal, yes. If you've got a gst/hst numbered registered, Amazon pays the taxes to you to remit. They don't do it on your behalf.

In other words:

Amazon collects the Canada Taxes off you

Only if you haven't provided them a GST/HST number.

Seller_ddISSOOudgFvJ

Just be diligent and make sure you get it all back when you file your GST/HST or whatever you need to in your province. Of course that's if you have a GST/HST number.

Seller_7LrAV0m5llaI7

I have a suspicion that the OP doesn't and that is why the OP is complaining.

Wait til the OP finds out all the extra money they could have made by claiming input tax credits

Seller_pD1oY8zUpVC13

you have to reduce the taxes you owe to government by the amount they refunded the client. so if you owe revenue canada for 100 you now only owe 100- 15.1-25.45-29.49. so you now only only owe 29.96.

Seller_kmRhEEJyqRIrB

Hello Everyone,

I have filed a better business bureau case with Amazon and Amazon responded with a remark that had nothing to do withe taxes. All Amazon was saying was that the buyer opened an AZ claim and that Amazon refunded the buyer.

This means Amazon is ignoring that fact that the taxes they collected during the original sale, they keep it and when there's an AZ claim involved they withdraw it off the seller's pay.

Amazon recently got a class action lawsuit this week......it's only a matter of time this will come our.

Canadian sellers who don't have GST/QST numbers:

Beware of any of your AZ claims, pay attention and make sure to file claim if you see Amazon refunding the taxes under your payroll.