INFORM Tax Interview "pending"

Hello all,

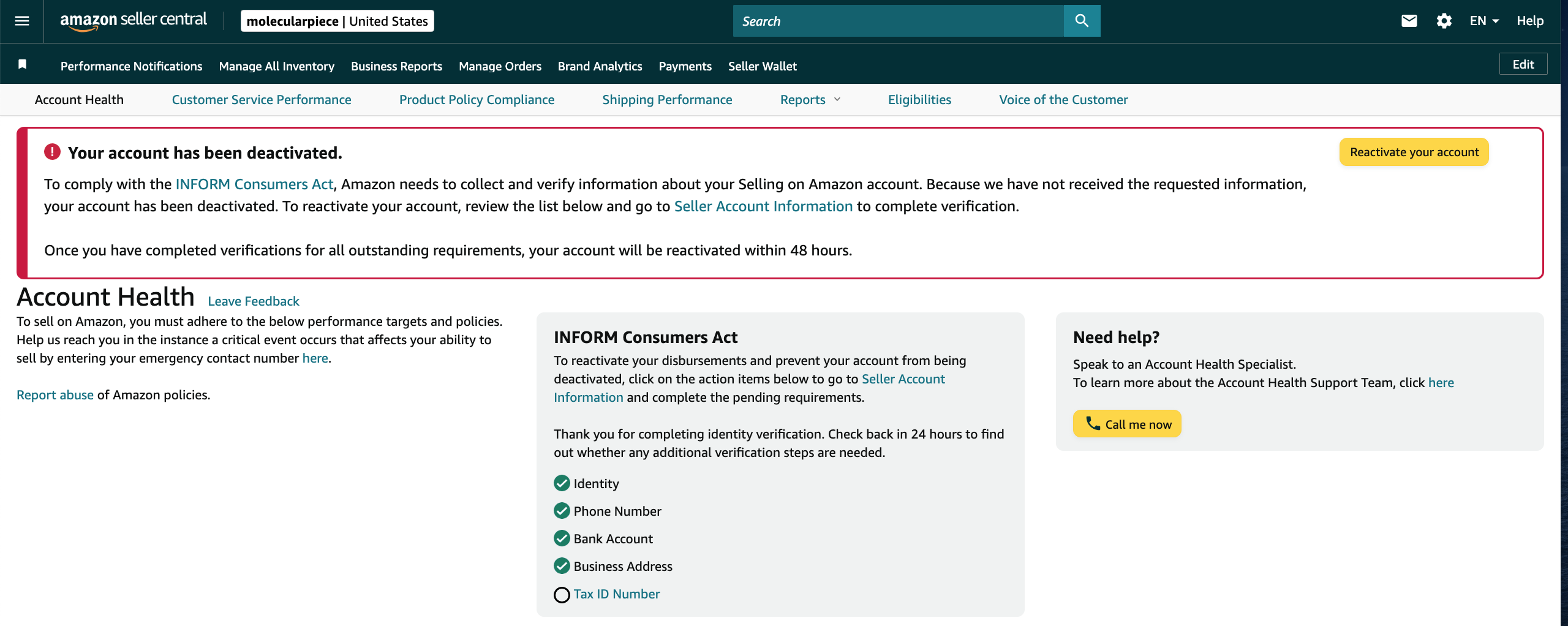

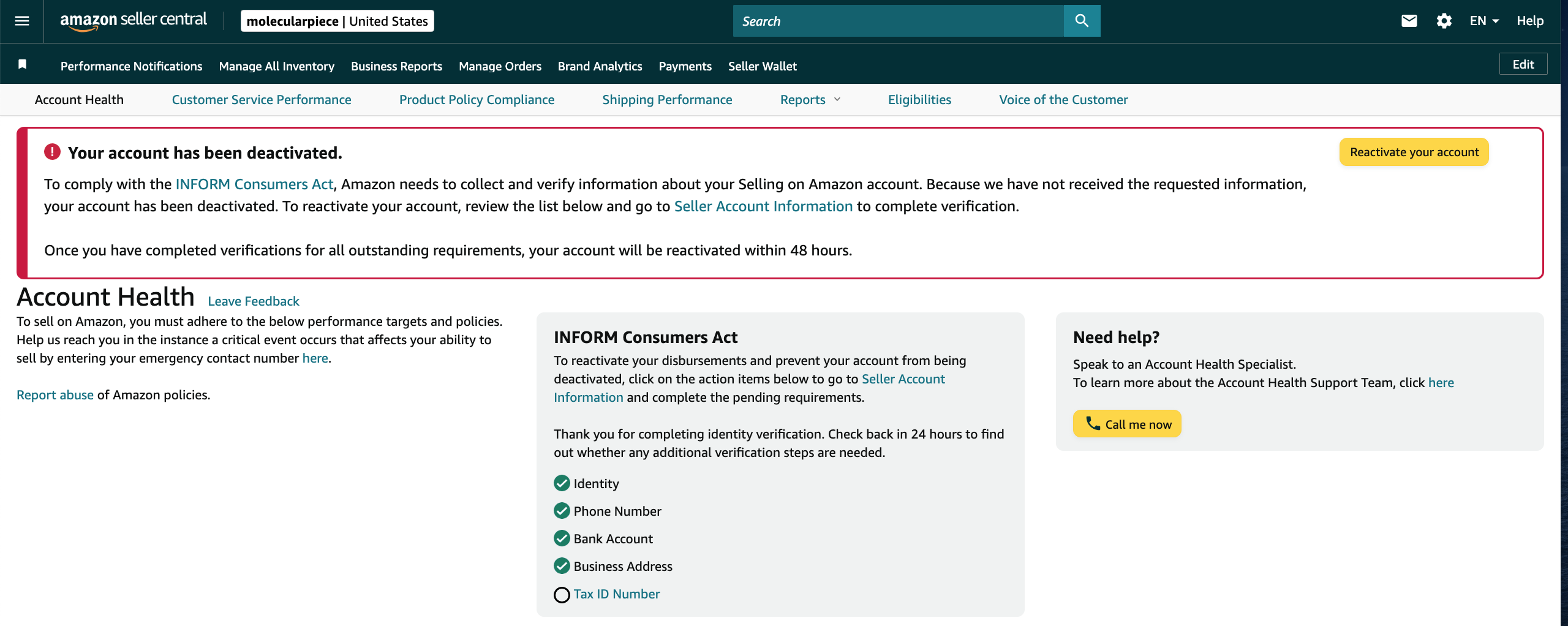

I just received an email telling me my account has been de-activitated due to unverified tax verification. Indeed, it is not my fault not to go thru this. It's purely due to Amazon's bug before. You can find the below threads if you are interested to know more:

https://sellercentral.amazon.com/seller-forums/discussions/t/dd3170ed-46bf-488f-a7e7-34f86bbdf585?postId=2066429f-ea2b-449f-b8f5-b6e0437f8989

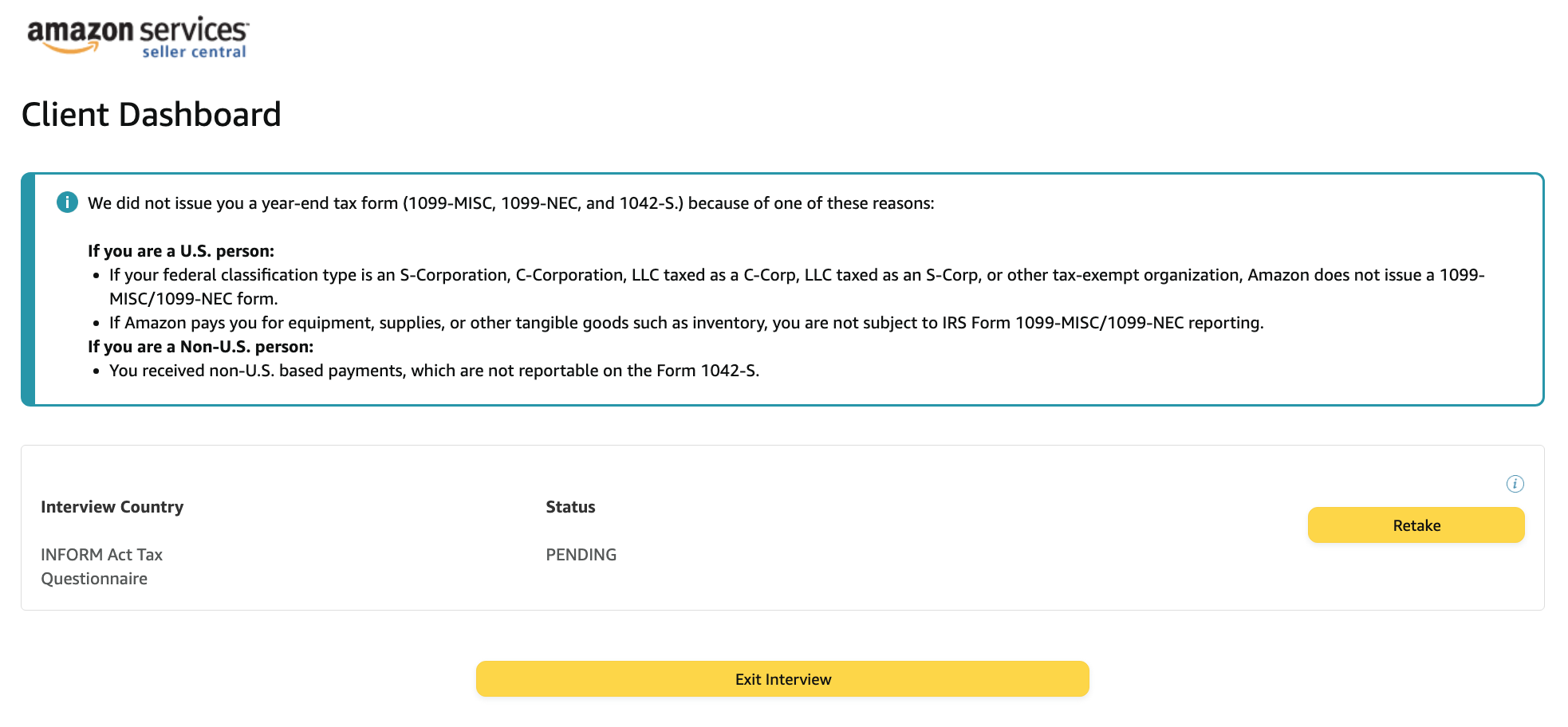

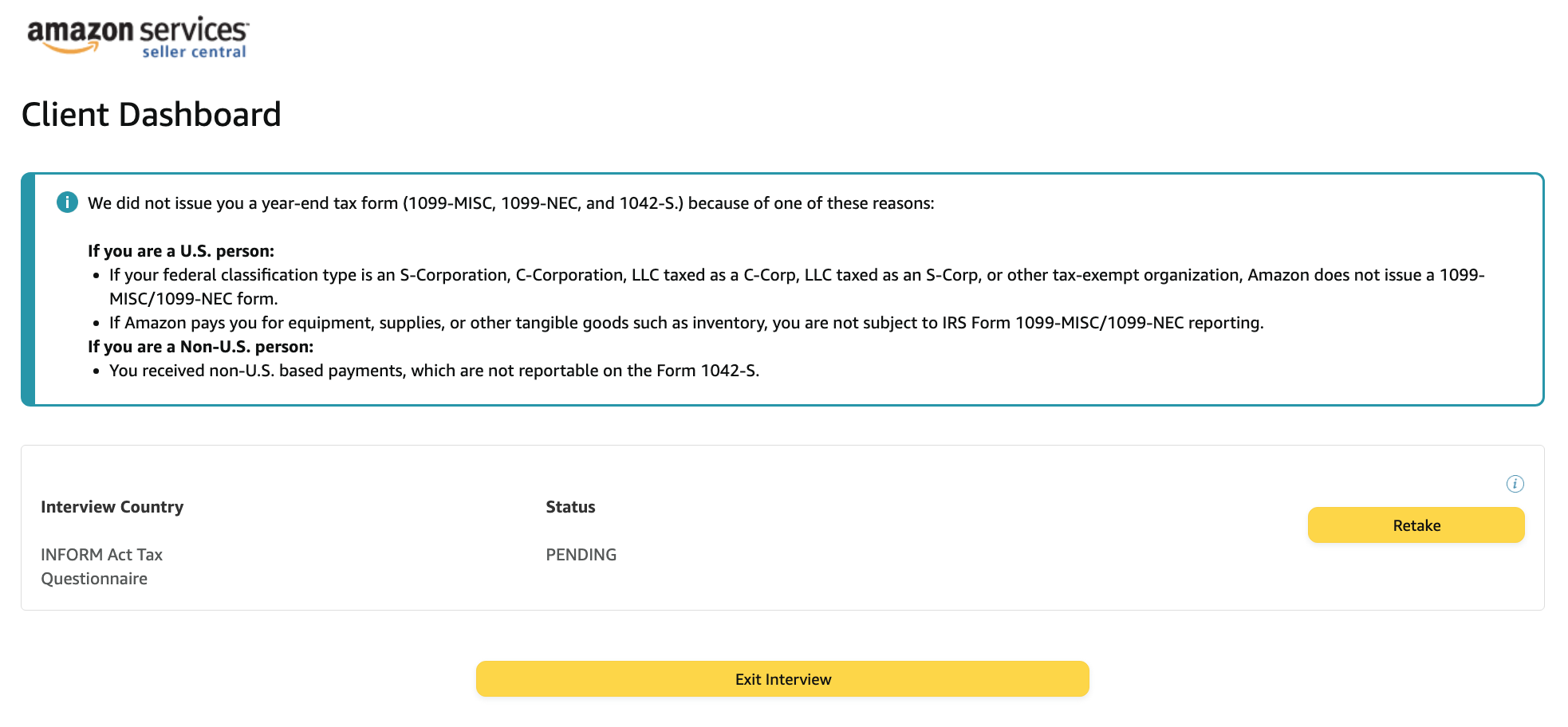

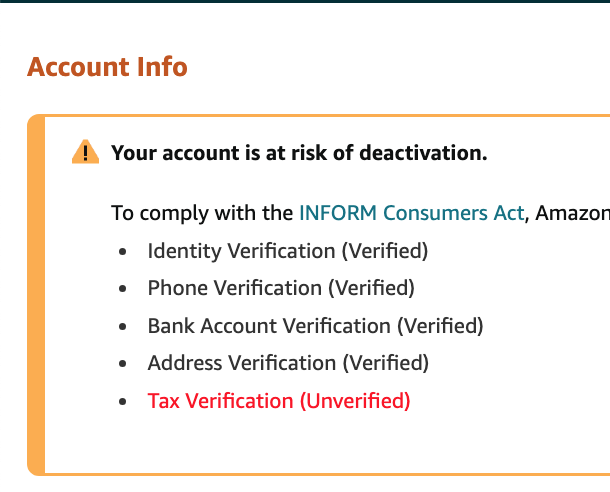

Back to the issue, with the status that my account has been de-activiated, I can proceed with the identity verification and it's green light now. The only one unverified is Tax Verification. I filled up all the information required and submitted. There was the attached landing page with PENDING.

I am not sure what does it means. Does it mean that it is pending for approval? Or should I retake it until it returns me a green light? I tried twice and the status were the same with pending. I even can't open a case for this manner because sellercentral do not have the option. STRANGE! Anyone can share me more? I am so frustrated now....

INFORM Tax Interview "pending"

Hello all,

I just received an email telling me my account has been de-activitated due to unverified tax verification. Indeed, it is not my fault not to go thru this. It's purely due to Amazon's bug before. You can find the below threads if you are interested to know more:

https://sellercentral.amazon.com/seller-forums/discussions/t/dd3170ed-46bf-488f-a7e7-34f86bbdf585?postId=2066429f-ea2b-449f-b8f5-b6e0437f8989

Back to the issue, with the status that my account has been de-activiated, I can proceed with the identity verification and it's green light now. The only one unverified is Tax Verification. I filled up all the information required and submitted. There was the attached landing page with PENDING.

I am not sure what does it means. Does it mean that it is pending for approval? Or should I retake it until it returns me a green light? I tried twice and the status were the same with pending. I even can't open a case for this manner because sellercentral do not have the option. STRANGE! Anyone can share me more? I am so frustrated now....

0 respuestas

Seller_nrSQRyhu8XEGM

Finally, I managed to open a support case# 14862816461

It seems to me that I didn't complete the questionnaire even I filled and submitted all the materials. At the sametime, it shows that I won't get the tax form since I am not US person nor US corporation. Whats should I do?

It is my only sales channel and as of this moment, I got 3 emails asking me where to buy my products other than Amazon (CRY)

Saeid_Amazon

Hello @Seller_nrSQRyhu8XEGM

Thank you for providing insight into the issues you are experiencing with your account.

Based on your post and the screenshots provided, I see your account has been deactivated as we were not able to verify the tax ID number.

Thank you for providing this information. The “pending” status means that we require additional information in order to verify tax information. So, the option here will be to retake the interview.

Sellers whose country of origin is not the US will not be auto-verified and will need to go through manual review, to confirm if they have completed the US Tax Interview and have a US TIN number.

Refer to the following steps to complete the manual tax verification process:

1. login to Seller Central.

2. go to the Settings menu and select Account Info to view your Seller Account Information page.

3. Go to Tax Information section and select Tax Information Interview page.

4. Review the information prefilled on the page.

5. Enter tax identification number (Note: returning sellers will see the tax information they provided earlier prefilled on the page, and they can update the info if required).

6. Upload a tax document.

7. Provide electronic signature.

8. Submit for verification.

Here's a help page that can serve as a guide to completing the verification processes.

The forums community and I are here to support you. Please let us know how we can help from this point forward.

Regards,

Saeid